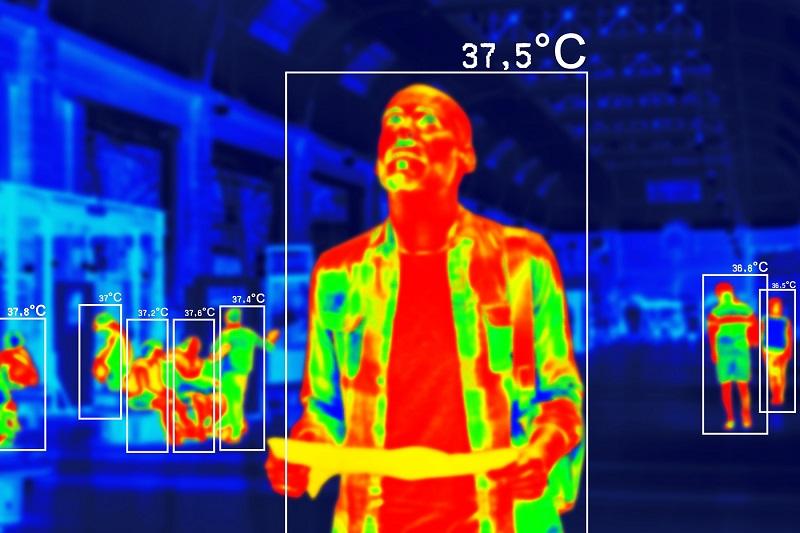

Expansion Trajectories: Thermal Screening Market Growth Drivers

The intelligent thermal screening market experiences robust expansion propelled by health security awareness and technology capability advancement. Comprehensive AI Based Fever Detection Camera Market Growth analysis identifies multiple drivers accelerating market development across dimensions. Pandemic preparedness prioritization sustains investment beyond initial COVID-19 response creating permanent infrastructure. Infectious disease awareness maintains elevated screening demand across healthcare, transportation, and public spaces. Workplace safety regulations increasingly mandate health monitoring protecting employees and visitors. Liability risk management drives corporate adoption preventing potential exposure-related legal claims. Smart building initiatives integrate thermal screening with broader facility automation and management systems. Border security applications expand screening beyond traditional checkpoints to comprehensive entry monitoring. Technology advancement improves accuracy and usability expanding addressable applications and customer segments. Cost reductions through component commoditization and manufacturing scale enable broader market accessibility. Artificial intelligence integration enhances effectiveness differentiating modern systems from basic thermal cameras. Growth drivers reinforce each other creating compounding expansion effects across thermal screening markets.

Market expansion forecasts indicate exceptional growth trajectories for thermal screening technology sectors globally. Research projections estimate the AI-based fever detection camera market growth will drive expansion to USD 16.08 Billion by 2035, demonstrating a compound annual growth rate of 25.22% across the forecast period spanning 2025 to 2035. This growth reflects sustained demand across multiple application categories and customer segments. Healthcare facility investment maintains permanent screening infrastructure protecting vulnerable populations and clinical staff. Corporate workplace deployment accelerates as employee health becomes strategic priority and competitive differentiator. Educational institution adoption scales protecting students and enabling safe in-person learning environments. Transportation sector investment correlates with passenger volume recovery and ongoing health vigilance requirements. Manufacturing facility deployment protects workforce health maintaining operational continuity during potential outbreaks. Entertainment venue adoption addresses attendee safety concerns and liability management for public gatherings. Government facility screening protects critical infrastructure personnel and visiting public. Retail implementation balances customer health protection with maintaining welcoming shopping environments. Diversified growth across verticals sustains long-term expansion trajectories.

Regional growth variations reflect different health infrastructure priorities and economic development stages. North America demonstrates strong growth from corporate investment and healthcare facility modernization. Europe balances expansion against privacy regulations affecting biometric data collection and thermal screening. Asia-Pacific exhibits exceptional rates driven by population density and infectious disease prevention priorities. China represents significant market with government-mandated screening across public spaces and facilities. India emerges as high-growth opportunity following smart city initiatives and healthcare infrastructure development. Southeast Asia accelerates as tourism recovery requires health screening capabilities at borders and attractions. Middle East invests in thermal screening supporting healthcare system enhancement and public facility protection. Latin America strengthens following economic recovery enabling health infrastructure investment prioritization. Africa shows nascent development as healthcare capacity building incorporates modern screening technologies. Regional variations create extended growth timelines as sequential global adoption progresses across markets. Geographic diversification optimizes vendor revenue reducing dependence on individual regional market conditions.

Growth enablers facilitate market expansion beyond fundamental awareness and technology drivers. Standardization initiatives reduce deployment complexity enabling broader adoption across customer sophistication levels. Privacy-preserving designs address data protection concerns without compromising screening effectiveness. Mobile deployment solutions provide flexibility for temporary locations and changing facility requirements. Integration standards enable interoperability with diverse access control and building management systems. Regulatory clarity provides confidence for long-term infrastructure investment and deployment planning. Financing programs overcome budget constraints through leasing and subscription payment models. Training availability develops operator expertise supporting effective system utilization and proper operation. Reference deployments provide proven implementations reducing perceived risk for cautious adopters. Industry collaboration develops best practices and shared learning accelerating effective adoption. Growth acceleration depends on removing barriers and improving accessibility across diverse customer segments and application scenarios.

Explore Our Latest Trending Reports:

- Art

- Crafts

- Dance

- Wellness

- Movie & Television

- Adult Entertainment

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Business & Finance

- Religion

- Shopping

- Sports

- Theater

- Drinks

- Other